.jpeg)

Based on the FTE calculations, managers can decide on the number of people required for a project in the future – let’s say, whether it is reasonable to hire one more developer or not. Full-Time Equivalent (FTE) is a critical metric in workforce management that expresses the total workload of employees in terms of full-time positions. It is used to measure the number of full-time employees that a group of employees or an organization’s workforce represents. FTE is a valuable tool for organizations across various industries as it aids in efficient resource allocation, budgeting, and decision-making. Calculating FTE involves determining the equivalent number of full-time employees based on the working hours of different staff members.

FTE acts as a valuable metric, aiding companies in accurately evaluating employee status and enabling compliance with labor rules. For instance, if the FTE exceeds 1 for full-time employees, it suggests that the organization is compensating for overtime. This value indicates that your company is investing in unnecessary expenditures. Here, you need to take some wise steps to handle this inefficiency in resource allocation. To calculate your FTE when applying for a PPP loan, take the average number of hours worked by employees each week for the covered period, divide by 40, and round to the nearest tenth.

Factors Affecting FTE Calculation

At FTE Tree, we support not only your operations leaders but also your finance and HR teams. Our software allows you to enter FTEs directly or as a specific schedule over various periods (1, 7, 14, or 28 days). We also support dynamic annual FTE hour calculations to ensure accurate annual cost estimates based on specific FTEs or schedules. For more information on configuring annual hours per FTE, visit our Help Center. For more support in calculating your organization’s Full Time Equivalent, download our free FTE Template and streamline your staffing calculations for efficient resource allocation.

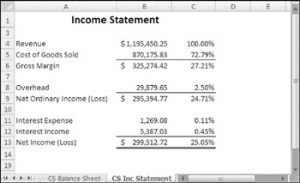

Calculating FTEs for Standard Accounting

The number of full-time equivalent employees is used to determine the amount of loan forgiveness for borrowers. For a 40-hour workweek, which is typical in the United States, an employee working 40 hours per week equals 1.0 FTE. Omni helps you track, analyze and gain actionable insights from employee data through an automated and digitized platform. Easily and quickly gather the data you need to calculate your organization’s FTE so you can spend more time on the strategic planning necessary to drive business outcomes. Tracking FTE calculation over time enables your organization to identify workforce trends and anticipate future staffing needs.

To find the equivalent of a full-time day, divide the total number of hours by 8. Five of them work full-time (40 hours per week), three occupy a part-time position each working 20 hours a week, and the other two each work 10 hours per week. For example, if your business pays a certain type of employee $40,000 a year for a full-time 40-hour workweek, an employee who works 25 hours a week would have an FTE of 0.625 and a salary of 40,000 x 0.625, or $25,000. Multiply the total hours worked in a week by 52, the number of weeks in a year, to find the number of hours worked annually. Full-time equivalent students8 is one of the key metrics for measuring enrollment in colleges and universities.

.jpeg)

Too often, HR will look at headcount metrics or other metrics in isolation rather than determining what these metrics mean from a business perspective. Linking performance with business outcomes in headcount reports will provide real value to business leaders and help you meet organizational goals. To calculate headcount, all you have to do is add up all your employees. HR departments use FTE to standardize their part-time employees’ working hours and salaries. First, it is necessary to determine the number of hours worked by part-time employees. Based on an FTE of 1.0, we calculate employees work 2,080 hours per year.

- Furthermore, the absence of a uniform gauge can result in inaccuracies in project planning, leading to potential financial losses.

- This approximation method becomes imperative for precise personnel strategizing and resource utilization.

- If a normal work week consists of 40 hours, an employee who works for 40 hours per week has an FTE of 1.0 while a part-time employee working only 20 hours per week has an FTE of 0.5.

- To identify the FTE of part-time employees, divide the total hours worked by part-time employees by the annual hours worked by one full-time employee (i.e., 2,080 hours).

By effectively utilizing FTE data, organizations can refine their talent acquisition strategies, make informed hiring decisions, and tailor employee development programs to meet both current and future needs. FTE metrics serve as a cornerstone not only in workforce planning and financial forecasting but also play a pivotal role intalent management and development. Integrating FTE into budgeting and financial planning processes is a strategic approach that aids in the precise allocation of resources and enhances decision-making for businesses. Employers can leverage these calculations to assess labor costs, plan for new hires, and ensure compliance with labor laws such as the Affordable Care Act (ACA), which often uses FTE as a metric for various requirements. It’s up to HR to determine which metrics will most help to leverage the headcount metric.

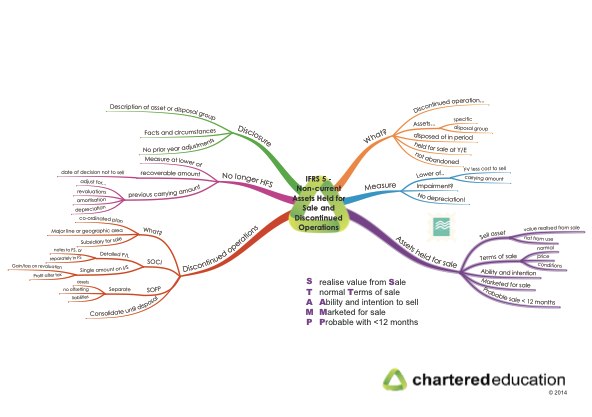

When to use FTE

While a full-time employee typically works a standard number of hours per week, a Full Time Equivalent is a unit that measures the total workload of multiple part-time or full-time employees. FTE considers all of your employees, regardless of their hours worked, on a standardized scale to represent the equivalent of one full-time employee. FTE is an full time equivalent indispensable metric in HR management, aiding in workforce planning, budgeting, and strategic decision-making.

FTEs are important for checking HR metrics and determining tax statuses for your business, but luckily they’re pretty easy to calculate on your own. Keep reading to find out everything you need to know about calculating FTEs and how to use them. It is critical for accounting purposes and determining wages, and for calculating the company’s expenses when paying its workers. A full-time equivalent (FTE) is a unit of measurement used to determine the amount of full-time hours worked by all employees in an organization. If a normal work week consists of 40 hours, an employee who works for 40 hours per week has an FTE of 1.0 while a part-time employee working only 20 hours per week has an FTE of 0.5. A full-time equivalent (FTE) is a unit of measurement used to figure out the number of full-time hours worked by all employees in a business.

If your company considers the number of hours for a full-time position as 40 hours per week, note that working 30 or more hours counts as 1 FTE for purposes of ACA compliance. A full-time position would equate to around 30 to 40 hours per week for most employers. If a company considers 40 hours per week as the basis for a full-time position, then anyone working an amount of hours below this range is considered a part-time employee. The same logic is applied if a company considers 30 hours per week as the standard for a full-time position. – this is the number of working hours spent by 5 full-time employees per working week.

All the above-mentioned factors end up costing the company something and affecting its bottom line. To identify the FTE of part-time employees, divide the total hours worked by part-time employees by the annual hours worked by one full-time employee (i.e., 2,080 hours). Particular nations or sectors, for instance, possess labor rules that delineate full-time and part-time employee categorizations based on the number of hours worked. In such scenarios, favoring FTE becomes pivotal to guarantee adherence to legal requirements and to precisely find employees’ eligibility to get certain benefits.

.jpg)

.jpg)

.jpg)

.png)

.jpeg)