This might involve gauging a firm’s productivity, profits, or efficiency in comparison to industry leaders. Seeking to improve or match the standards set by successful competitors can drive innovation and improve overall market competitiveness. Cloud-based finance software can give you complete visibility over data needed for financial benchmarking. Real-time accessibility on any device with an internet connection ensures that you can make smart decisions on-the-go without tying yourself to a desk. Context is important when assessing financial performance and that’s where financial benchmarking helps.

Invest in cloud-based finance software

Manufacturing companies also can use inventory composition as a benchmark. Companies must report the composition of the inventory balance in the notes to the financial statements. You usually break down your inventory account into raw materials, work in process and finished goods inventory.

Benchmarking Limitations

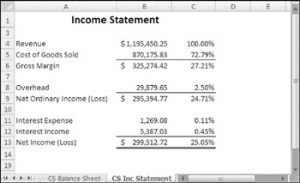

If you’ve sourced raw data from financial statements, you’ll need to convert it into a financial metric that represents a benchmark. To do that, you’ll need to calculate their gross margin and net margin and prepare a list. In the trading comparables method of valuation, similar businesses are used for establishing the valuation range of a corporation.

Choosing Relevant Financial Metrics

For example, a company that has a much larger balance in finished goods than the other two accounts could have a buildup of inventory. In contrast, a company with low finished goods inventory relative to raw materials inventory might be having trouble keeping up with demand. However, just as with all benchmarks, small-business owners should interpret the information the best they can, but be careful in jumping to conclusions from the results of one benchmark. A significant juncture between benchmarking and CSR rent receipt template is in the area of responsible investment benchmarks. In essence, these are performance metrics that integrate CSR principles into the investment framework. Companies heavily utilise responsible investment benchmarks to gauge the success of their CSR initiatives.

CSR refers to the self-regulating initiatives businesses undertake to ensure their practices align with societal expectations and ethical norms. It encapsulates various facets from environmental sustainability to fair labour practices. As companies strive to align their operations with CSR principles, benchmarking provides a tangible pathway to achieve this the death of lifo goal. Despite the valuable insights they offer, benchmarks should not be the only factor informing investment decisions.

Sign up today and we’ll do one prior month of your bookkeeping and prepare a set of financial statements for free, valued at $299. QuickBooks, Xero and other do-it-yourself bookkeeping software give you a tool to do your own bookkeeping and taxes. When you know how to read your financial statements, you can find ways to increase your profit and catch problems before they grow. Your team of bookkeeping experts review your transactions and prepare financial statements every month.

- The company conducts a search to find another organization that is considered to have mastered the activity.

- The goal of this phase is to identify where your business falls short compared to the reference point, and what may be causing this.

- It’s a tool that significantly contributes to gauging efficiency and profitability.

- At-a-glance visual reports help you see the big picture and give you actionable insights to help you grow your business.

Corporation J’s performance is viewed as the benchmark or standard or best practice. Metrics such as standard deviation or Beta use the sales tax deduction calculator (which measures an investment’s volatility relative to a benchmark) can be incredibly illuminating. Benchmarks are not static; they should be reviewed and updated regularly to maintain relevance. This process helps you accommodate changes in industry standards, consumer behavior, or your company’s goals.

When benchmarks aren’t readily available, you can establish them manually using the information in listed company filings. Always use the latest benchmark data when possible to keep comparisons consistent with reality. For example, a company’s revenue may grow 10% even in an economically bad year because of its great reputation in the market. During the current year, there was a surge in the demand for umbrellas because of the highest number of rainy days over the past decade. Company Q will study Corporation J’s performance and procedures in depth and will identify the differences between the organizations. Company Q will likely modify its procedures in order to bring its performance of the activity up to the level attained by Corporation J.

This company has a negative EBIT margin in the actual year, followed by a high EBIT margin in Year 1. It also has low sales growth in the actual year, followed by very high sales growth in the following year. Operating working capital as a percentage of revenues is dropping in the estimates when compared to historical performance.